Secrets of growing via YouTube9/20/2023 Recently, I've been spending about 2 days a week on researching, scripting, recording, editing, and sharing YouTube videos for Stock Card. I had hoped content would be a source of organic user acquisition, and it is, but not as big as I hoped. The biggest impact is on engaging our existing users, showing there is always something new to discover on Stock Card. For example, the number of Stock Card views per month by existing users has gone up by 40% in the last 3 months vs. the previous 3-month period. This is great news, but I still need ways to grow our user base faster. To do so, I have to make our content more appealing to a broader audience. I've been taking Ali Abdal's Part Time YouTube Academy course (PTYA) and here are a few ways I've learned to improve our content's acquisition performance. There are a few ways to do so:

In this post I summarize my ideas across all parts of the above funnel (loop) as I learn them. I may update this post several times in the future and add new ideas to it. Let's go! IdeasThis is where I have the most struggle. How to come up with an idea with broad appeal that is still relevant to our personal finance and investing enthusiast middle-age men. The most common method every YouTube academy and course suggests is to find what works for others, and "copy" it. If you find and idea that has worked for other channels, in your niche or elsewhere, and ask yourself:

Finding the idea that you can copy, or replicate its pattern becomes harder. But there are patterns that can work:

Some Examples: VidIQ YouTube channel has a video series with this pattern: <Target Audience>: Do THIS to <Amazing Results> in <Unbelievable Time>. If I want to use that pattern for our investing category, these could be good ideas:

Side note: The challenge, for me personally, is to make content that is still valuable and make people's lives better, while going viral in the finance category. There is a thread by Jamie Rawsthorne on how he and his partner, Zac Alsop, grew their YouTube channel to ~1.5M subscriber even starting with their first few videos by doing videos on the topic of "faking" a model or a celebrity, etc. They actually put a lot of work into their videos' productions. The end video is fun and engaging, and made those guys thousands of dollars in advertising dollars from YouTube, but the content category is "junk" entertainment, like Mr. Beast stuff. I can be naïve but I do not want to be one of the people who produces junk content that only engages people, although I'm jealous of their success. Now Jamie has moved on and is working with more serious creators, Cody Sanchez and Austin Reif, and collaborating with the likes of Angus Parker (General Manager of Ali Abdal's channel) proving that his framework can work in other categories. Now I understood how Cody Sanchez suddenly rose to the top on YouTube. It's the framework that is proven. I should be able to replicate it. His framework in summary is:

ThumbnailsBright colors work better. Faces on the thumbnail build trust. HookHooks have to be short, engaging, and to-the-point. Assume the audience doesn't know you, so no references to the past. Front-load editing efforts. ConvertComing soon - there is something about Tweet-style landing page by Greg Isenberg that I really like. Will talk about it soon. Wow (Engage)Coming soon - there is something about minimum Wow product (instead of MVP) by Tim, partner at PlatformOS. Will talk about it too. MonetizeComing soon RetainComing soon

1 Comment

Less Is More8/29/2023 Recently, one of our users complained that we sent him too many pop-ups. Actually, he used more aggressive language. He called us obnoxious. LOL! In this case, the user is not right. He is a free subscriber, and we send our free users many pop-ups to encourage them to upgrade. After all, we need to eat too ;) Joking aside, there is something to say about too many words and too much content.

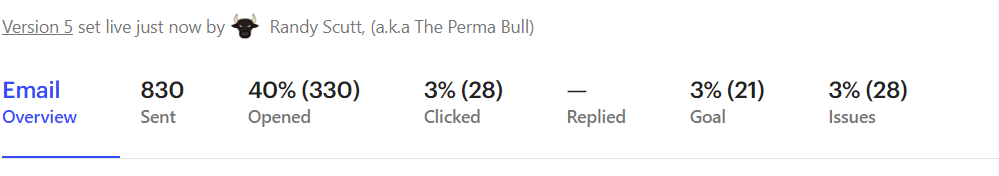

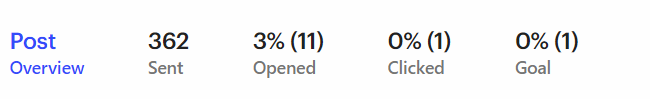

I look at my behavior. I only read some of the emails I receive. Even the ones I open, I glance through and cherry-pick stuff. When I visit a new website, a quick scroll and a few keywords capture my attention. In the noisy world we live in, less is indeed more. On that note, I started an experiment today: We used to send 4 onboarding emails in the first 14 days of a user signing up. I stopped all of them. Not on the hunch that "less is more", but based on their dismal click-through rate and high spam/unsub rate. Now, we have one single welcome email. I spent the entire morning writing the briefest, most-to-the-point message I could. I also added the link to the content I created based on another experiment I'm running to make an irresistible offer to our users by showing them making better fundamental investments is possible. Here's the current (version 5 in Q3 2023) onboarding Open Rate, CTR, and Spam/Unsub rate. Let's see how the experiment turns out in the next few weeks. It's all about the funnel5/30/2023 There was a time that I hated the term funnel. It seemed to me it was an old-school way of acquiring users. How can a modern start-up has only one simple funnel to acquire users. This must be a page out of old-school webinars and shady high-price courses and low-quality content sellers.

Over the years, my point of view has changed. Now, all I think about it how to strengthen Stock Card's funnel. Let's talk about our current funnel: Content brings potential users to Stock Card. This content can be our YouTube channel or Podcast show, my Twitter or LinkedIn posts, Stock Card's blow, or creators' content we sponsor. Potential users watch the content, and at some point, get triggered to sign up for a free account on Stock Card (about 30%). We do our best to make an irresistible offer, and some (about 2%) convert to paying user after a free trial. A simple funnel is the best kinds because its easier to manage and nurture. I'm still working on the irresistible offer part of our funnel because there is a lot to do there with content. However, growth is very much dependent on top of the funnel. The bigger the top, the more valuable the funnel itself. How big of a funnel does Stock Card need? Let's say at some point I decide to sell Stock Card to tiny.com, a Canadian tiny conglomerate that buys profitable small companies. I typically use their criteria to buy a company as the NorthStar for Stock Card. That doesn't mean I don't want Stock Card to be giant unicorn or a decacorn. But I believe making a tiny profitable company is in my control, whereas building a unicorn or a decacorn is very much dependent on luck, circumstances and things out of my control. I focus on building a valuable company, and I keep my eyes open for luck and circumstances to jump up. Here are the criteria:

These criteria resonate with me. If I were to build an investment company, I would have included some of all of the above criteria. But I digress. My intention was to show the NorthStar of the our funnel. Let's do some math:

That's the top of the funnel! 1.7M in annual traffic. Where do we get that kind of traffic, and is such a traffic possible? Simply Wall Street has more than 4M in monthly traffic, Benzinga brings 6M, and TradingView hovers nearly 180M per month. And those are just a few examples of companies in the investing category. They get their traffic through SEO, content marketing, news feeds to others, and widgets. In other words, they create value for other companies, an in return, get traffic back to their website. How can we replicate those models? Good question, right?! Let me think about if for a while. Be fearless under pressure5/19/2023 The old wisdom that what doesn't kill you make you stronger works super well in entrepreneurship. For example, if you are scared of pitching to VCs, once you do it a couple of hundred times, you don't dread them anymore, and at some point you get good at it, even. Getting exposed to tough situations (an employee leaving, almost running out of cash, or not being sure of the next steps) and surviving through them makes the next encounter a lot more easier. However, over the years, I learned there are ways you can accelerate this learning process and become fearless faster. Here are the tricks that will do:

Here are the top three questions one can ask in tough situations to become fearless:

Making an irresistible offer5/10/2023 The more I grow into my career as an entrepreneur, the more I realize "selling" is the most important skill to succeed. There are many ways to sell you (the person) and your product, and today I want to explore one of the frameworks I recently came across. My goal is to use this framework to come up with an irresistible offer I can send to our user at Stock Card to convince them to start a 14-day Free Trial for our Full VIP offering. The idea comes from Alex Hormozi, the founder of several of companies and the author of $100M Offers book (This is an affiliate link). He teaches entrepreneurs to create an offer that people feel stupid not accepting. A good offer creates a vacuum around your product. It "de-commoditize" it in a way the customers feel they are buying something so special they can't get anywhere else and they don't compare you with others. Is The Market There? Before we getting to the offer itself, I want to reiterate something Alex has mentioned in his free courses on its website, Acqusition.com. To succeed, you need at least a normal market that grows with the population. There needs to be people in this market that have a pain to remedy, and can afford to pay for your services or products. You need to have away to access them (e.g., via a list or social media platform). I went through this exercise about Stock Card's market and it helped me validate I'm on the right track. In the case of fundamental stock market investors, I stress tested our market against those criteria:

Ideally, per Alex, by specifying the niche, we should be able to charge higher. In Alex's words, there is a big portion about pricing your product. I believe what he talks about and how he explains the price itself equates with the perceived value of the product. However, I would want to put pricing exercise aside. If the improvement of the offer works, I'll come back and revisit the pricing. Craft The OfferIf we've built a product that address the needs of our niche customers, why the conversion rate isn't as high as we hoped. We have two conversion points at Stock Card. 1) Visitor to user conversion, and 2) User to paying user conversion. Our first conversion hovers around 30%, and the second at around 2%. From what Alex says, we can improve the perceived value of our product and improve the conversion out of the thin air with crafting the right offer! I'm drooling over this. His formula for creating such an offer has two parts:

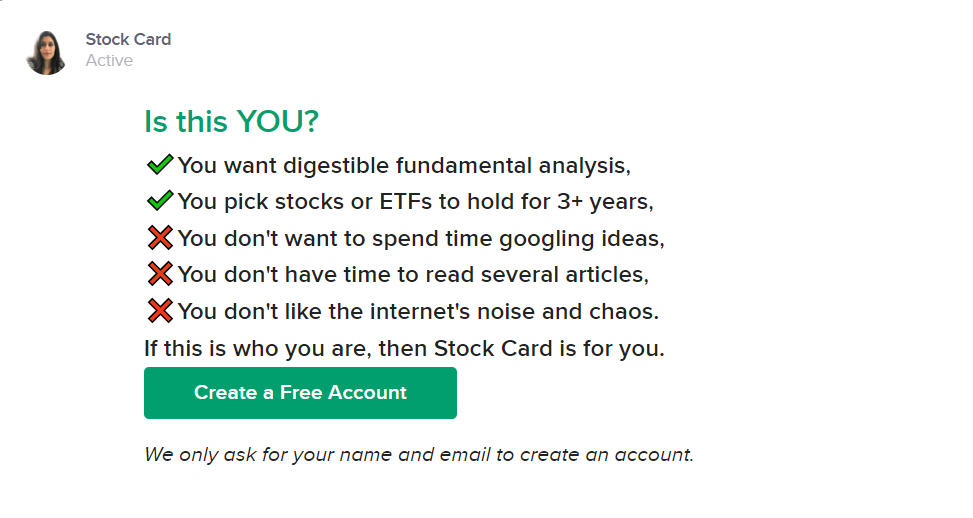

To reduce the risk associated with the offer, you also have two tools available: 1) Reduce the time it takes for the user to achieve the dream outcome (or at least show the progress), and 2) Reduce the amount of sacrifices they need to make to achieve the outcome. Beautiful! Right? Let's see how this applies to Stock Card's VIP subscription. At Stock Card, our goal is give our users, the active fundamental investors, the ability to generate higher investment return. We do that by providing them digestible investment insights that helps them make fewer mistakes and better investment decisions faster than what's possible without us. The internet is noisy and chaotic, and focusing on the information that matters is time-consuming. We use design and data automation and a deep knowledge of fundamental stock market investing to give investors the insights they need and understand. The desired outcome is higher investment results. But there are issues with that. It's hard to prove that every user is likely to achieve that outcome, because we don't control the market, users, their time-horizon, and their behavior in terms of sticking to their plan. Also, by nature high investment return requires long time gap between when the research is done and when the return is achieved and the user has to make a lot of sacrifice such as tolerating the pain of losing money. That's why people tend to be easily convinced to pay for stock-pick alerts and technical analysis that is short-term by nature, vs. what we do at Stock Card. How can we address those? Define the Dream OutcomeThe formula here is to XX [specific outcome] in YY [Time Period] without [biggest pains and fears]. Let's try a few options for Stock Card:

And, this is the Dream Outcome pop-up: Once the dream is defined what are the excuses that the user may to not accept the offer we are making to them. What prevents our users to accept that we can help them with their fundamental analysis without spending too much time on the internet, reading articles and googling things? The reverse side of it that what do people need to do to achieve the outcome:

Now the question is how can we solve those problems with Stock Card?

Crafting the OfferAccording to Alex, products and services are on two apposing continuums. They are either 1) easy-to-sell but hard-to-fulfill (such as the I give you best stocks model such as TMF, or 2) hard-to-sell and easy-to-fulfill (like Stock Card that is hard to sell because there are still work to be done by the users and sacrifices to me made on their behalf to achieve higher investment return, but once sold, it's easy to fulfill because its a software).

Ideally, we want move Stock Card to a done-for-you model but also easy-to-fulfill which doesn't need lots of analysts and readings to fulfill the promise. Interestingly, that's where partnership with financial creators were supposed to come in. We were supposed to add TMF-like service without the difficulty of running done-for-you operations but it didn't work for now because the creators weren't engaged or incentivized enough to make the model work. In other words, we either had to give creators the distribution to grow or the money to compensate them, and the money was too expensive. I'm going on a tangent here. Using creators without having the distribution turned out to be too costly and didn't solve the fulfilment issue of done-for-you solutions. Back to the "crafting the offer" I should be able to offer "done for you" model, and then once we make money and then gradually move it to "do-it-yourself". What are some of the things we can do for making the offer "done-for-you" model?

Here, let me stop and think. What if we cancel the entire Stock Card for fee and then and only charge for high-value support and one-on-one coaching at a price such as high as 10X the current price, what would it look like? It is a scary thought, I have to say. We lose our current revenue stream, but we may be able to make even more money that what we make right now by offering that super high price point model. What's the rush, though! I can test things out first and then move into that model. The current price-point we have doesn't allow me to do the super hands-on things such as on-demand research something together. But, using templates, I should be able to sweeten the deal and improve the value for the current VIP offering. The beauty of templates is that we can still do it once and deliver it to millions, so its only the upfront investment that costs me. if it works, then we can reduce the price to allow for more conversion, and also still work on the very high-ticket price offer after, especially because more high-value stuff take time away from creating content and acquiring users. Some food for thought to figure out whether those high-touch, high-value stuff is worth offering. Alex recommendation is also to avoid providing several high-value, high-cost things. Continuing on that chain of thought, we can offer one thing such as a one-on-one portfolio review which is a very high-cost offer. Here, I pause. I plan to create the content that allows us to make our offer to VIP users irresistible. I'll be back with an update soon. Rules of frog-kissing11/19/2021 A lot has changed in our journey to raise a seed round:

Self-pity5/7/2021 When I was young, my Dad taught me to work hard, be honest, study, and learn, and the universe will reward you. I didn't realize back then, and it took me 40 years to understand that my Dad's definition of reward was very different from mine. My Dad wanted me to have a good job, buy a nice house, raise a good family, live near my family, access good health care, road, and schools, and take vacations once in a while. I indeed achieved those things. But, those weren't my definition of reward. I dreamt of building a company, finding a partner I love unconditioanlly, having more money than gods, and going on crazy adventures. I tried to make my dreams true, but I kept following my Dad's formula. And, the universe hasn't rewarded me the way I wanted.

I followed my Dad's formula at school, and I got good grades. I followed his formula in my corporate job, got a good salary and bought a comfortable house. I followed my Dad's formula in building my company, and I built a small company that makes money. And, I recently moved to live near my family. By my Dad's count, I'm a massive success. By my count, when I go to bed at nights, the last thought that takes me to sleep is, "how did I become such a dismal failure in my life?" I recognize this is a moment of self-pity... Good night you trickster universe... Remember this, Mr. VC!5/23/2020 Three years ago:

Two years ago:

One year ago:

This year:

One year from now:

Where will you be in 3 years?10/27/2019 I've been working with my coach, and he made me do an interesting exercise. He said, it's 2022, and we meet in an airport. He tells me, hey, how are you? How have you been? How's Stock Card. And, I had to act out exactly how I imagine I would explain my life and Stock Card's progress to him. The exercise took us down the road of identifying how I plan to make the vision come through. Originally, I assumed, this is the easiest exercise. I know exactly where Stock Card would be by then. I thought, in 30 minutes, I can write down the plan and be done with the exercise. That was three weeks ago, and you know what I'm still working on? You guessed it correct. I'm still working on the 3-year plan. It's too expensive!6/1/2019 I call BS! The number one reason people (our users and our team members) bring up as an excuse for not upgrading is that the subscription is too expensive. I hear it, but I don't buy it. Cheap or costly is a perception of value. When they say the subscription is too expensive, the chances are that two things are happening:

I plan to resist a price-cut for a few more months, and instead, focus on addressing the above two hypotheses. Let's go through each one with a few details. They are not the right target customer (Topic for a future post): Finding the right target customer is hard. We'd like our customers to be younger people. And, we would also want them to old enough to be ready invest a few thousand per months, so our subscription price is worth it to them. They also have to be in the middle as far as investing experience goes. Not too early as an investor that they still don't know what Fair share price is, as an example, and not too advanced that they have their own Google sheet with formulas and plugins. There is this narrow and nice slice of the pie that works for us. If I say this sentence to a VC or an angel investor, they will walk away because they think the size of our target customer is too small. If I do not focus on these people, then I have to walk away because the product doesn't make money. I'm planning to focus on our target customer. However, this topic is more related to our traction strategy and needs more thinking. We have some thoughts, most importantly, we are thinking of our embedding and widget tools. However, more on that in a different post. They don't understand the product yet: One thing before I get to the this discussion is that I think customer feedback is BS (I know, blasphemy!). We can't just ask them do you understand how this product creates values for you. Customer feedback for UI and UX works, because people can show you what they see, and how they see it and how they interpret it. However, customer feedback related to product development is not good enough. People have a hard time verbalizing what they need and how they want it. But, the question is how do we plan to figure out whether the users understand our product? Most people are reactionary creatures. You put a feature in front of them, and if they use it, you know that it's working. If they don't, you still don't know if they don't like it. Maybe they haven't seen it? Perhaps, they haven't understood it. So, let's peel the onion layer by layer (Elon Musk style) to figure out why the users don't understand the product:

|

© COPYRIGHT 2015 - 2023. ALL RIGHTS RESERVED.