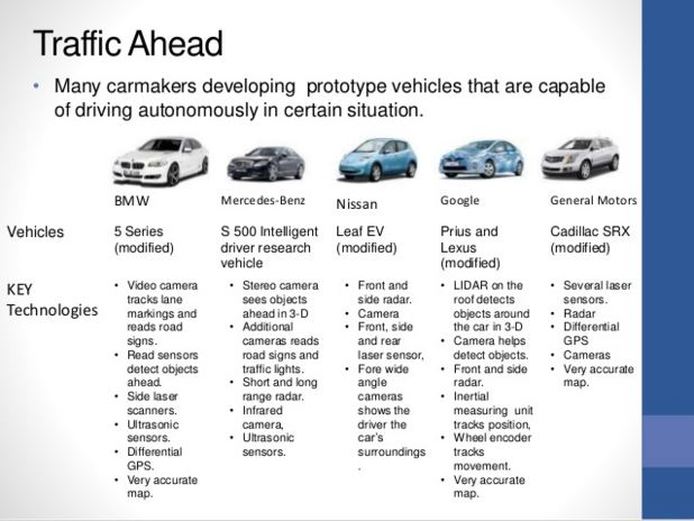

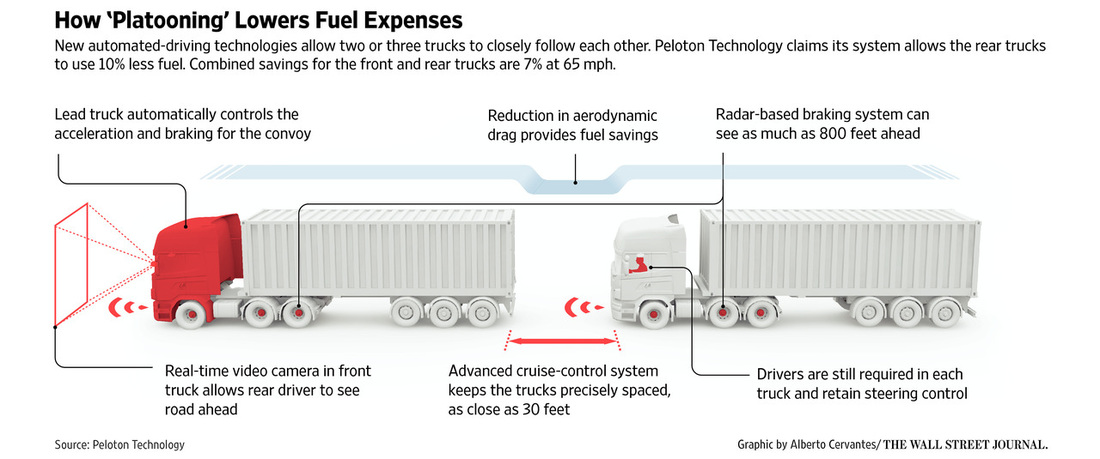

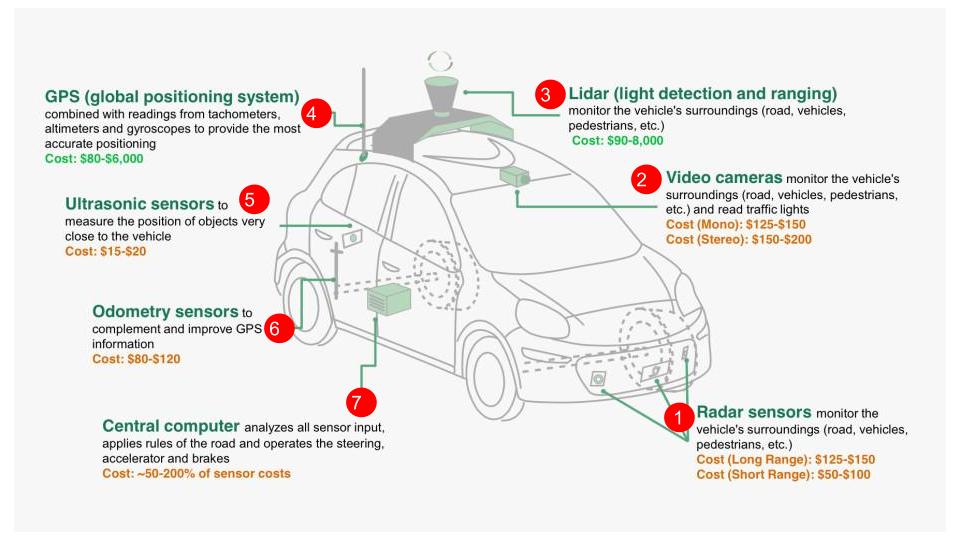

Car Manufacturers The first thing you must know as a consumer is that already many car manufacturers have some level of autonomous technology built into their cars. Many of existing manufacturers are letting Google (ehhh... I meant Alphabet) battle the legislators and break down the customer adoption barriers, while they happily use autonomous car features to make their cars smarter. BMW's 2016 Series 7 features driver-less parking and speed limit obedience technology. Mercedes-Benz and even Tesla Model S autopilot technology are also good examples. While you are at it add Baidu and BMW's joint efforts to bring driver-less cars to the mass populations in couple of years and GM's joint venture with Chinese automaker SAIC to build a hybrid autonomous volt by 2030 (Chevrolet-FNR). The slide below is a bit outdated but has a good summary of who is doing what among the manufacturers. Commercial Fleet (e.g., transportation and dump trucks) This usage of autonomous technology makes so much economical sense but not so many people talk about it (I guess because Goolge and Tesla are the ones people get all hot about and transportation and dump trucks are not so sexy). In any case, in the U.S. alone +60% of goods are transported through truck fleets and up to 40% of the cost is due to fuel. One autonomous feature that allows for truck drafting (developed by Peloton Technologies) would save up to 10% of fuel cost. Imagine a snake of trucks cruising close to one another (at the distance not safe enough for a human operator but perfectly fine for an instant reaction of a computer). The first truck operated by a human and the rest all follow the alpha truck in front. So the economic model behind it pays for the R&D and upfront expenses. I won't even talk about the 30% cost of drivers that could be fully eliminated at the end state of a fully driver-less trucks. Daimler (Mercedes-Benz) has already piloted a driver-less truck. While Caterpillar and Komatsu are good examples of already in-use autonomous cars in mining and dump trucks. Technology players: Now that we know who are the most immediate users of autonomous car technology, it is time to focus on the technology they are using. In its simplest form the technology for a driver-less luxury BMW sedan or a rugged mining Caterpillar mammoth has 7 components (see the image below). The one thing you should know that will help define which companies are worth your investment is that these seven types of tech providers are not all the same and broadly grouped into two types:

1 Comment

Leave a Reply. |

© COPYRIGHT 2015 - 2023. ALL RIGHTS RESERVED.